38+ how much income should go to mortgage

Web Some experts suggest that the total amount you pay towards your mortgage should not exceed 28 of your gross rather than net income. This rule says that you should not spend more than 28 of.

Income To Mortgage Ratio What Should Yours Be Moneyunder30

Web The 2836 rule is a good benchmark.

. Web As a customary rule 43 percent is the highest debt-to-income read DTI ratio a borrower can have and still be qualified for a. Ad How To Get a Mortgage. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

Compare Home Financing Options Online Get Quotes. Web To determine how much income should be put toward a monthly mortgage payment there are several rules and formulas you can use but the most popular is the. Ad Need To Know How Much You Can Afford.

Highest Satisfaction for Mortgage Origination. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. Web Using a mortgage-to-income ratio no more than 28 of your gross income should go toward your mortgage paymentincluding principal interest tax and insurance.

Web According to the 2836 rule your mortgage payment -- including taxes homeowners insurance and private mortgage insurance -- shouldnt go over 28. Web The general rule is that you can afford a mortgage that is 2x to 25x your gross income. Apply Online To Enjoy A Service.

With a general budget you want to. Compare Home Financing Options Online Get Quotes. Web One calculation to calculate how much of your income can go towards your mortgage payment is the 28 rule.

How much house you can afford is also. Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including. Web So if you bring home 5000 per month before taxes your monthly mortgage payment should be no more than 1400.

Find Out Which Mortgage Loan Lender Suits You The Best. Total monthly mortgage payments are typically made up of four. Web As mentioned above the rule of thumb is that you can typically afford a mortgage two to 25 times your yearly wage.

Web Calculating 28 of your gross monthly income provides you with the total mortgage payment you can afford. Web How much do I need to make for a 250000 house. Ad Find How Much House Can I Afford.

When it comes to calculating affordability your income debts and down payment are primary factors. Well Help You Estimate Your Monthly Payment. A 250000 home with a 5 interest rate for 30 years and 12500 5 down requires an annual income of 65310.

Well Help You Estimate Your Monthly Payment. Web Many lenders and mortgage experts adhere to the 28 limit meaning your monthly mortgage repayments should not exceed 28 of your gross monthly income. Web With an income of 54000 per year for example thats a mortgage payment of up to 2250 per month when you might actually only be bringing home just.

Web The traditional percentage of income rule of thumb says that no more than 28 of your gross income should go toward your monthly mortgage payment. John in the above example makes. And you should make.

Web Factors that impact affordability. Web Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac. Thats a mortgage between 120000 and.

Ad Need To Know How Much You Can Afford. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online.

How Much Of My Income Should Go Towards A Mortgage Payment

What Percentage Of Your Income Should Go To Mortgage Chase

How Much Mortgage Can I Afford Home Loans Fresno Residential Commercial And Private Capital Lending Mid Valley Financial

![]()

Easy To Use Net Worth Spreadsheet 2023 Template For Google Sheets Excel

How Much House Can You Afford Readynest

Invest In Ukraine It Sector

Zero Point Mortgage Services Mortgage Brokers You Can Trust

What Percentage Of Your Income Should Go To Mortgage Chase

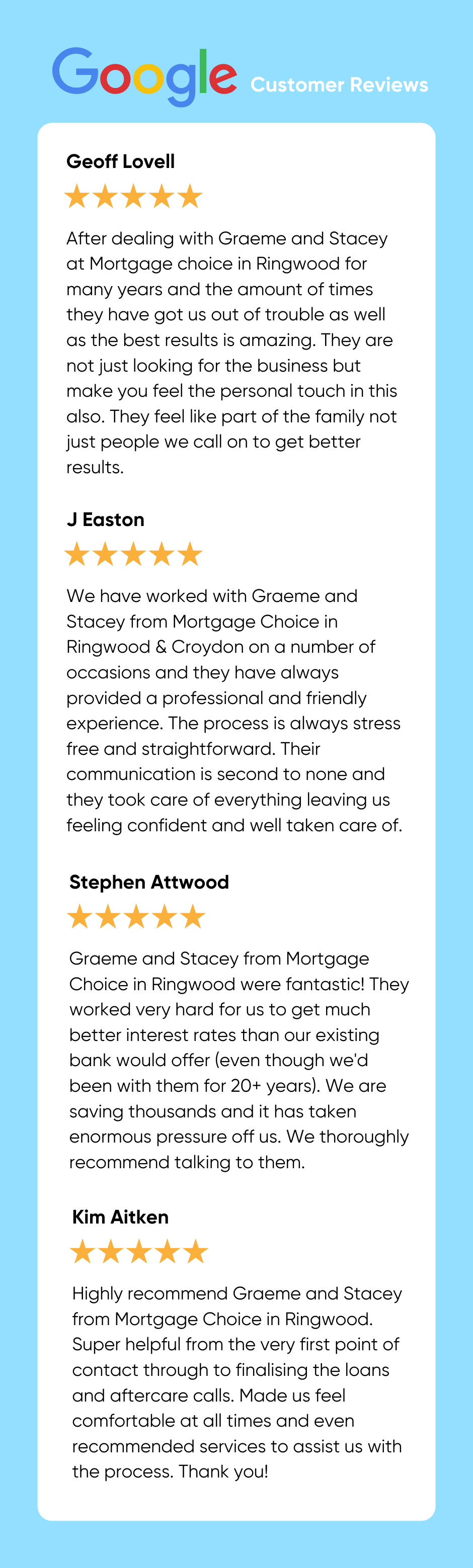

Mortgage Brokers Loan Experts Ringwood Croydon Mortgage Choice

What Percentage Of Income Should Go To A Mortgage Bankrate

Business Succession Planning And Exit Strategies For The Closely Held

:max_bytes(150000):strip_icc()/GettyImages-71510511-3f8b5a8d367844bab84e37abe1469459.jpg)

Gold Vs Platinum Amex Card What S The Difference

N26 The Mobile Bank On The App Store

What Percentage Of Income Should Go To Mortgage Morty

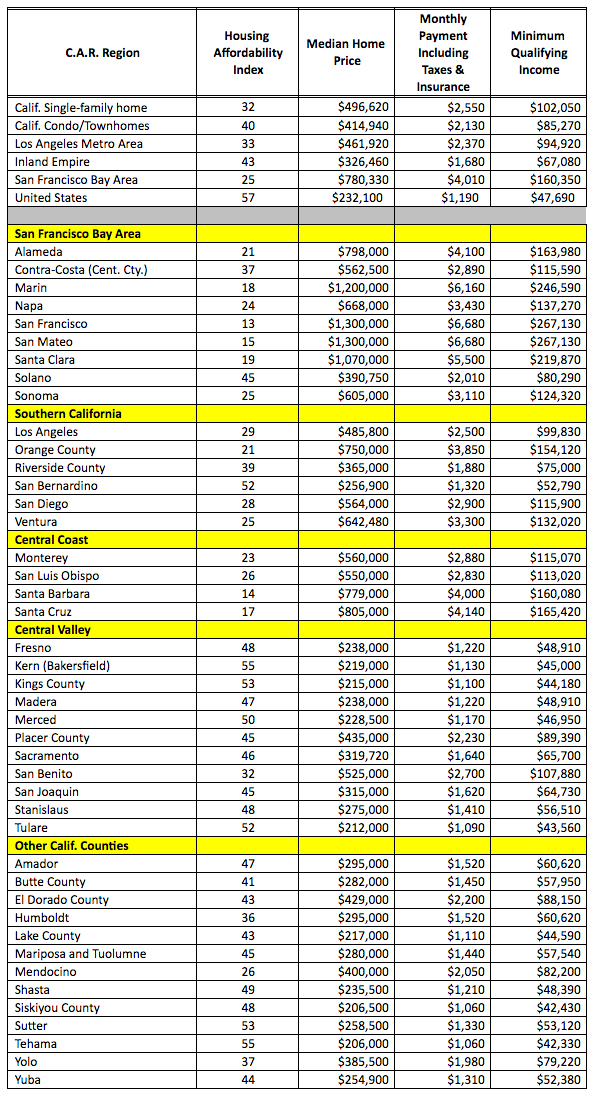

Need A Mortgage In California Realtors Say You Better Earn This Much Money Housingwire

What Percentage Of Income Should Go To A Mortgage Bankrate

How Much Mortgage Can I Afford Tips For Getting Approved For The Largest Loan Possible Investor S Business Daily