Traditional ira withdrawal tax calculator

Ad Its Time For A New Conversation About Your Retirement Priorities. Yes Spouses date of birth Your Required Minimum.

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Find a Dedicated Financial Advisor Now.

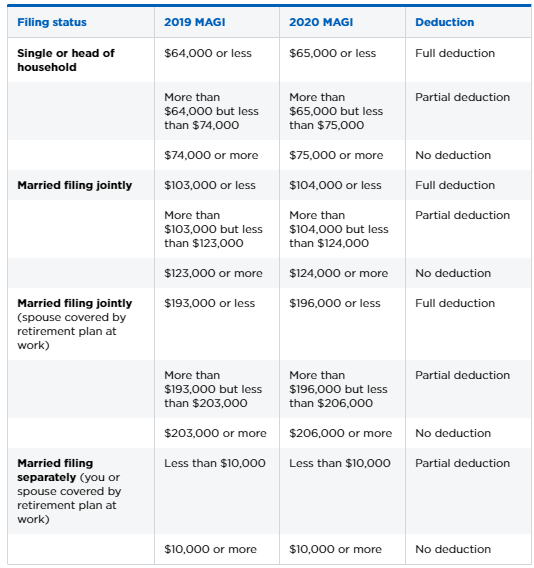

. 6 13 20 Withdrawing 1000 leaves you with 610 after taxes and penalties Retirement Plan Withdrawal Calculator Definitions Amount to withdraw The amount you wish to withdraw from. Choosing between a Roth vs. For the tax year 2020 full deductibility of a contribution is available if your Modified Adjusted Gross Income MAGI is 104000 or less joint and 65000 or less.

For example assume you have a 30 combined state and federal tax rate. Ad Make a Thoughtful Decision For Your Retirement. Build Your Future With a Firm that has 85 Years of Retirement Experience.

Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Ad Its Time For A New Conversation About Your Retirement Priorities. Ad Looking for home loans.

Here you can also check the amount of fixed annual contribution you. The RMD for each year is calculated by dividing the IRA account balance as of December 31 of the prior year by the applicable distribution period or life expectancy. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year.

If you dont have that information. The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset. If you satisfy the.

Calculate your traditional IRA RMD Your date of birth Account balance as of 1231 of last year Is your spouse the primary beneficiary. 35 percent for income between 200000 and 500000. If youre single and.

The 2 trillion CARES Act wavied the 10 penalty on early withdrawals from IRAs for up to 100000 for. Ad Contributing to a Traditional IRA Can Create a Current Tax Deduction. Find updated content daily for popular categories.

Use AARPs Free Online Calculator to Calculate Your Tax Deferred Growth. 2022 Early Retirement Account Withdrawal Tax Penalty Calculator Important. And 37 percent for income over 500000.

To calculate the penalty on an early withdrawal simply multiply the taxable distribution amount by 10. 32 percent for income between 157500 and 200000. Traditional IRA depends on your income level and financial goals.

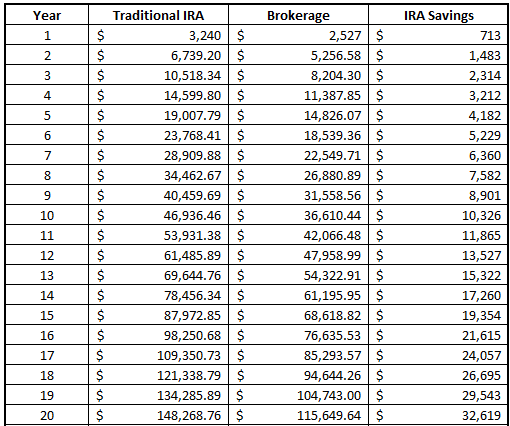

Use the Tables in Appendix B. Traditional IRA Calculator can help you decide. The traditional IRA calculator is an easy tool to calculate the maturity amount you will get on your fixed annual contribution.

Traditional IRA Calculator Details To get the most benefit from this calculator you should use data that reflects your current financial situation. Your Taxable Account Deposit is equal to your traditional IRA contribution minus any tax savings. Do Your Investments Align with Your Goals.

You can use Internal Revenue Service tax tables or an online calculator tool to figure out what tax bracket youre in and estimate how much tax youll pay on a particular IRA. Comparing Traditional Iras Vs Roth Iras John. Traditional IRA Calculator Calculate your earnings and more Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth.

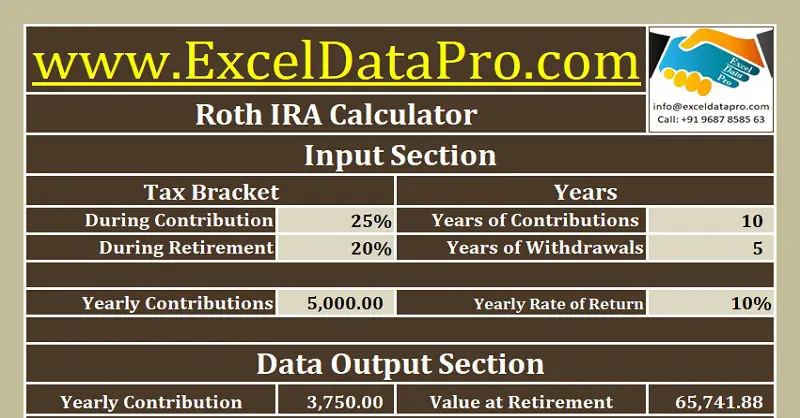

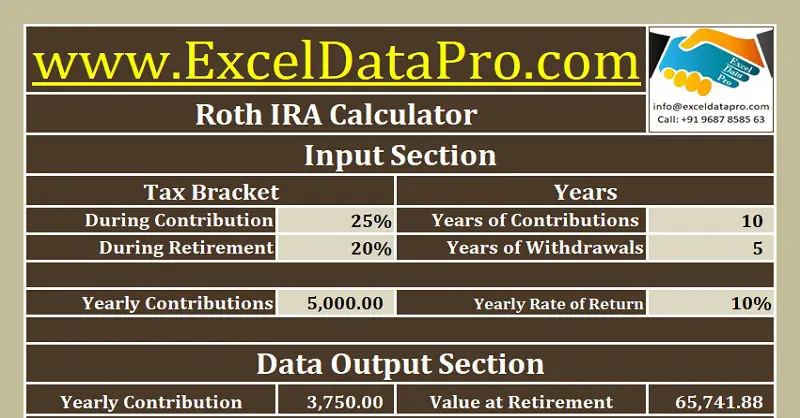

Traditional Vs Roth Ira Calculator

Traditional Vs Roth Ira Calculator

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

How To Compute An Ira Minimum Withdrawal

Download Traditional Ira Calculator Excel Template Exceldatapro

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Download Roth Ira Calculator Excel Template Exceldatapro

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Federal Income Tax Templates Archives Msofficegeek

Download Traditional Ira Calculator Excel Template Exceldatapro

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Download Free Traditional Ira Calculator In Excel

Ready To Use Traditional Ira Calculator 2021 Msofficegeek

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal